History Repeating

You may not know this if you’re not a geek and don’t follow these things obsessively, but there’s a bit of an earthquake going on in the world of laptop computers.

Laptops have traditionally come in two basic forms: small, sleek and expensive ($2000+), or big, clunky and cheap ($1000 or less). But last year Taiwanese vendor Asus blew that model all to hell by releasing the EEE PC, a super-small, super-sleek notebook PC about the size of a hardcover book that started at just $350. In a market where laptops the size of the EEE typically run closer to $2,500, this was a real game-changer.

(How did they do it? By scaling back on the amount of processing power and storage in the machine. The EEE isn’t powerful enough to replace your desktop; it’s really optimized for simple tasks like Web surfing, e-mail, and basic office tasks. But, surprise surprise, most people only use their laptop for Web surfing, e-mail, and basic office tasks, so the extra power isn’t missed.)

Predictably, the EEE was a huge hit, and now other vendors are sniffing around at producing similar machines as well. Some, like the MSI Wind, have already reached the market, and others are soon to arrive, including one from Dell.

So I was a bit surprised to see the New York Times reporting that “Smaller PCs Cause Worry for Industry“:

The personal computer industry is poised to sell tens of millions of small, energy-efficient Internet-centric devices. Curiously, some of the biggest companies in the business consider this bad news.

In a tale of sales success breeding resentment, computer companies are wary of the new breed of computers because their low price could threaten PC makers’ already thin profit margins.

Yes, while Asus is making hay trying to keep up with the demand for EEE PCs, more established laptop vendors are holding off from offering their own versions out of fear that these new cheap machines will eat into sales of conventional laptops:

“When I talk to PC vendors, the No. 1 question I get is, how do I compete with these netbooks when what we really want to do is sell PCs that cost a lot more money?” said J. P. Gownder, an analyst with Forrester Research…

“We’re sitting on the sidelines not because we’re lazy. We’re sitting on the sidelines because even if this category takes off, and we get our piece of the pie, it doesn’t add up,” said Paul Moore, senior director of mobile product management for Fujitsu. “It’s a product that essentially has no margin.”

Why do I mention this? Because it is deeply ironic. The personal computer, after all, was not born as a high-margin business — it was born as a super-cheap alternative to the minicomputer, a class of machines that dominated data processing in the 1970s. Where a PC might sell for $5,000, a minicomputer’s price, reflecting its far greater power, could run into the hundreds of thousands of dollars. The first PCs had so little processing power compared to minis that they were widely derided as little more than cheap toys, suitable for dinking around with at home, perhaps, but not for Serious Business.

As tiny startups like Apple churned out PCs, the dominant minicomputer vendors, companies like Control Data, Honeywell, DEC, and Wang, all chose not to compete with them. Why? Because the margins on a personal computer sale were much lower than the margins on a minicomputer sale. They feared (rightly) that if PCs became popular, their minicomputer business would die — and with it the fat profit margins they’d grown accustomed to.

Of course, we all know how that story ended; today the market for computers is dominated by the companies that bet on the PC, and the companies that tried to hold back the tide either became irrelevant or went out of business altogether. When was the last time you met someone who did their work on a system from Control Data? When was the last time you met someone who even knew the name Control Data?

And if one wanted to, one could go back even further and see how the minicomputer vendors were themselves once the scrappy insurgents, peddling cheaper alternatives to the mainframes offered by the IBMs of the world, whose price ran in the millions and whose per-sale margins were even higher than those in the world of minis.

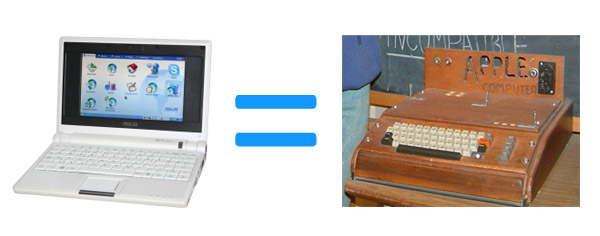

If the history of computers teaches any lesson, it is this: if two alternative products both meet a basic performance baseline, the cheaper alternative always wins. It may take time; when a new, cheaper alternative to the status quo first emerges, it’s usually underpowered, more of a proof of concept than anything else, and it takes a few revisions before it matures into a product that’s ready for the mass market. The Apple I, for example, wasn’t compelling enough to take the world by storm. But it helped prove that there was a market for the personal computer, and its follow-on, the Apple II, was capable enough to strike the first serious blow at the dominance of the minicomputer in business IT. When IBM looked past its fear of cannibalizing its mini business to produce the IBM PC, the death knell for the mini had been rung.

That’s why it’s so ironic that some personal computer vendors — whose entire business was built on replacing expensive, high-margin hardware with cheap, commodity low-margin hardware sold in volume — should suddenly decide that there is such a thing as “too cheap” after all, and hope to kill off the new paradigm by refusing to shift to it. Do they not know the history of their own business? Do they not know the fate of every other computer company that has tried to fight “cheap and simple” by ignoring it rather than adapting to it?

As the saying goes, “Those who cannot remember the past are condemned to repeat it.” Those vendors who are hoping the days of the $2,000 laptop will last forever would be well advised to ponder that.

Comments

Sandy

July 21, 2008

5:17 pm

“If the history of computers teaches any lesson, it is this: if two alternative products both meet a basic performance baseline, the cheaper alternative always wins.”

Price discrimination in a mature market (which PCs are gradually becoming) doesn’t always work this way. The same thing may be marketed at different price points to different folks, depending on their price sensitivity. Bug sprayers will offer a $50 service in poor neighborhoods while getting the $100 monthly contract in rich neighborhoods. Ford had the Ford brand for its cheaper cars and sold identical versions except for styling with a higher price under the Mercury brand.

The trouble they, like the Big 3 (soon to be Big 2) automakers, will have, is that they haven’t been offering a real alternative in either the design- and brand-conscious market, nor have they been low enough priced to compete in the commodity market. Hence Hyundai and Toyota have been eating the Big 3 from both ends, but Sony Viaos and Lenovo Thinkpads may still sell in the laptop space.

Jason Lefkowitz

July 21, 2008

5:32 pm

“Hence Hyundai and Toyota have been eating the Big 3 from both ends, but Sony Viaos and Lenovo Thinkpads may still sell in the laptop space.”

Oh, I don’t think that the $2,000 laptop will go *completely* extinct. Hell, people still buy mainframes:

http://www-03.ibm.com/systems/z/

But mainframes don’t drive the IT marketplace anymore. They’re niche products for a niche audience. We’ll probably see the same with the $2,000 laptop becoming a niche product for the performance- or fashion-obsessed.

“Ford had the Ford brand for its cheaper cars and sold identical versions except for styling with a higher price under the Mercury brand.”

Which worked fine when the Big 3 owned the market and could divide it up amongst themselves as they wished. But when that cozy arrangement was broken up by foreign competition the strategy no longer made sense. Mercury sales have been in decline ever since:

http://blogs.motortrend.com/6244846/editorial/the-trouble-with-mercury/index.html

“Mercury sales peaked in 1978 at about 580,000 vehicles a year. Even in 1993, FoMoCo managed to shift 480,000. But just 195,000 Mercurys were sold in 2005, 180,000 in 2006, and 168,000 last year.”