Getting It Wrong

Over at the usually pretty insightful Marginal Revolution, there’s a post today by Alex Tabarrok that attempts to take Paul Krugman out to the woodshed over his much-blogged-about graph showing the Bush administration’s consistently rosy job growth projections:

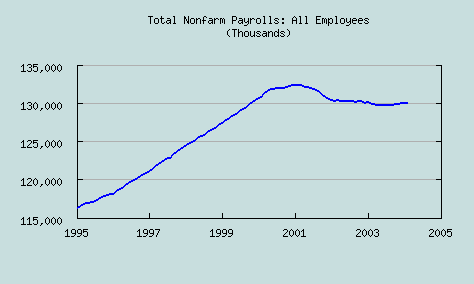

Tabarrok’s basic claim is that Krugman’s assertion that the Council of Economic Advisors (CEA) has been fluffing the numbers for political reasons is off-base, because Krugman didn’t show the whole picture in his graph. By only showing data going back to 1999, Tabarrok claims, Krugman skews the picture, making it look like the CEA’s projections were rosier than they should have been. Tabarrok says that Krugman should have gone back to 1995:

He claims that this explains the CEA’s projections, as simply a “return to trend”.

Quite frankly, I think this is more obvious spin than anything in Krugman’s piece. The reason is because of Tabarrok’s choice of years for his chart. He starts with 1995 — the start of the ’90s boom! Of course jobs grew enormously from 1995-2000. The economy was going like gangbusters. But why would anyone in their right mind, in 2002 or 2003 or 2004, predict a “return” to this trend, when the economic fundamentals had so clearly changed?

The CEA was predicting boom-like job growth, and it didn’t materialize — and Tabarrok claims that we need to put the predictions in perspective by looking back to the way things were before the bust. Hey, I wish I could; my investments were sure doing better! But that economy is gone, gone, gone, swept away by the popping of the tech bubble and the September 11 attacks. Anyone who made a prediction in 2002 that by 2004 it would “return” deserves whatever scorn Krugman sends their way.

A better comparison, if Tabarrok really wanted to provide perspective (and not spin), would have been a chart that went back to the last recession — say, one that started in 1990 or so. It would be instructive to see how CEA’s predictions hold up when compared to the U.S. economy’s actual performance in recovering from a recession. But since those years aren’t on the chart, I imagine the answer is that they don’t hold up very well…

Like I said, Marginal Revolution is a smart site, and usually does better analysis than this. Let’s hope they aren’t going to be spending much time in the future making weak excuses for political hackery like these job projections.

UPDATE: This discussion is continued at Getting It Wrong, Revisited.

Comments

George Davis

March 15, 2004

6:32 pm

The graph marginal uses is one of the options that the St.Louis Fed “Fred” site provides. If you look at the maximum range, marginal’s point is still well taken. The maximum range link is http://research.stlouisfed.org/fred2/series/PAYEMS/11/Max .

Jason Lefkowitz

March 15, 2004

8:12 pm

See, this is why I love blogs — they let people defend other people’s writings better than the original authors did 🙂

So the ’95 time horizon is a limitation of the data-visualization tool. Interesting. The site you pointed to lets you download the raw data so I may just grab it and see if I can’t come up with a chart that I like better than either one of these…

Michael Giberson

March 15, 2004

11:06 pm

Krugman should page through the last 40 years of White House budgets and similar documents.

He is correct that political propaganda has taken the place of professional analysis — well, “taken the place of” is a little strong, let’s just say “augmented” — but such augmentation is hardly unprecedented.

Jeffrey Miller

March 16, 2004

12:58 pm

When you look at “forecasts” like those under discussion there are really only two plausible alternatives:

1. The CEA deliberately produced absurd

“forecasts” because it was politically expedient.

2. The CEA produced the best “forecasts” they could using well accepted econometric methods and did not alter the results for political expediency.

If the first alternative is correct, then the authors of the report are political hacks (a la Krugman).

If the second alternative is correct, then well accepted econometric methods have no ability to predict simple quantities like job growth even in the very near future.

In either case, the only reasonable conclusion that one can draw is that one should have very little confidence in the prognostics of the the current CEA.

The Big Picture

March 19, 2004

12:00 pm

Why Jobs Forecast keep failing

Once more, into the breach: If Economists were baseball players, most of ’em would have been sent down to the minor leagues a long time ago. They’ve nearly all been wrong. It ain’t called the Dismal Science for nuthin.’ Consensus expectations for job c…

Barry Ritholtz

March 21, 2004

9:45 am

The CEA can hardly be excused by claiming they were merely “predicting a return to trend.”

That excuse would be quite handy when any predictive error came up. Wouldn’t it make my job easier anytime an analysis or predictive error occurred, I could simply pronounce “Trend Reversion! Trend Reversion!”

That was the same excuse commonly given by Perma-Bull equity strategists in the beginning of the Bear market in 2000. “Hey, we were only forecasting a return to the previous trend.” Pretty silly.

Why even have a CEA or any economic advisors? Just look at a chart of any phenomena, track the prior trend, assume a reversion. (Perhaps not).

It takes skills and perceptiveness to know when not to default to a “return to prior trend.” Obviously, this is an intellectually foolish excuse, failing as it does to recognize changing market and econmic conditions in the post-bubble environment.

Barry Ritholtz

March 21, 2004

9:45 am

The CEA can hardly be excused by claiming they were merely “predicting a return to trend.”

That excuse would be quite handy when any predictive error came up. Wouldn’t it make my job easier anytime an analysis or predictive error occurred, I could simply pronounce “Trend Reversion! Trend Reversion!”

That was the same excuse commonly given by Perma-Bull equity strategists in the beginning of the Bear market in 2000. “Hey, we were only forecasting a return to the previous trend.” Pretty silly.

Why even have a CEA or any economic advisors? Just look at a chart of any phenomena, track the prior trend, assume a reversion. (Perhaps not).

It takes skills and perceptiveness to know when not to default to a “return to prior trend.” Obviously, this is an intellectually foolish excuse, failing as it does to recognize changing market and econmic conditions in the post-bubble environment.